Why KPIs for Asset Management

Asset management is meant to cultivate market value so investments can increase its returns. As an Asset Manager, you want to maximize yields and make sure that market values for investors keep growing. When focusing on the longer-term, strategic big-picture by maximizing the value of each rental property, you might need to keep an eye on certain Asset Management KPIs. Those can help you track changes faster and makes reporting easier. KPIs for Asset Management can support the process of reducing expenditures, finding the most consistent and highest sources of revenue, and mitigating liability and risk.

Previously we have written about the 5 important KPI’s in property asset management. Today we want to dive a bit deeper into this topic. Let’s have a closer look at KPI’s for Asset Management. Those you might need for creating an overall strategy for your rental properties and the entire real estate portfolio. These KPIs will also help you improve asset value by wisely reducing expenses and increasing income.

Defining the right KPIs for your business

Keep in mind, KPIs are there to help you reach a certain goal and track your performance.

- Specific – the KPI should have one widely accepted definition that eliminates the risk of others taking interpretive liberties which prevents it from being a true standard.

- Measurable – a KPI provides a valid measure that accurately defines a standard, budget, or norm achievable – a KPI standard has to be clear and detailed enough to be actionable

- Relevant – the KPI must measure some real and critical aspect of the organization’s strategy and directly contribute to achieving it, otherwise it is useless “noise”

- Time-phased – a KPI should, ideally, express a relationship between the performance measure that is chosen and the time frame over which it extends in order to establish a temporal baseline for future KPI comparisons.

# Occupancy rate

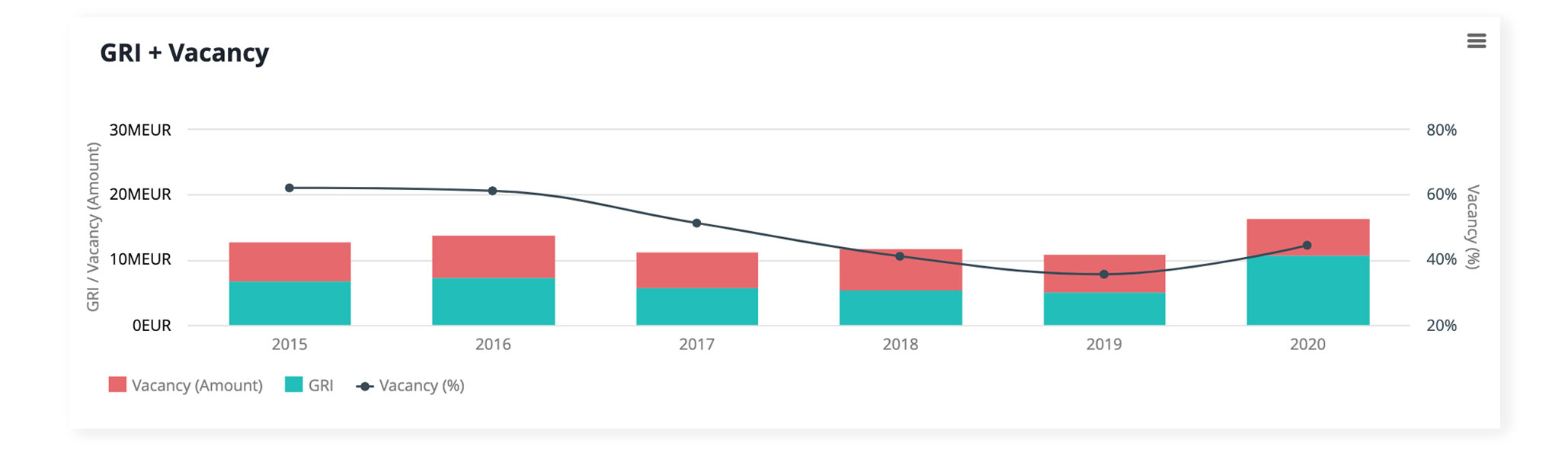

Occupancy rates are important to real estate investors because these numbers provide an indication of expected cash flows. By following this Asset Management KPI, you can see how much of the spaces are leased. And you are able to compare it to the total amount of available space owned by the investor. It also shows the current status of the rental situation.

Usually, a real estate player purchases several residential apartments or commercial units, and they maintain a portfolio to control the performance of a specific asset class. Their primary intent is to collect rental income through lease agreements in these units. Therefore investors try to assess the performance of the real estate portfolio and potential of an individual property by measuring the occupancy.

Why track this Asset Management KPI?

Investors rely on the business case when acquiring new real estate. If an investor buys a property with a relatively low occupancy rate, they have to spend time and money to find new tenants. They take a risk of not filling the spaces, while still facing maintenance costs and property taxes on top of them. Therefore, it is essential for the investor to follow the development of the occupancy and control the original business case of improving the portfolio and property occupancy.

#GRI (Gross Rental Income)

Another important KPI for Asset Management is GRI. At the highest level, gross rental income is simply the amount you collected in rent and any related revenue from your rental properties. The gross amount is the amount you received before deducting any expenses like insurance, operating expenses and taxes or investments related to the property. It is in the investor’s best interest to maintain the highest level of GRI compared to the market rent and condition of the leased unit.

Why track this Asset Management KPI?

GRI indicated an annual income of a property. Knowing gross rental income and operating expenses will help you to crunch the numbers of a rental property and define the profitability of the investment.

Any investor relies on gross rental income when modelling their cash flow. Covering the costs of the property and future investments can mean the difference between making a successful investment or being burdened with a money pit.

#Maturity

Maturity or WALE / WAULT (Weighted Average Lease Expiry) is a way of measuring the average time period in which all leases in a property will expire. It indicates when properties, parts of properties, or groups of properties are likely to fall vacant and cash flow from rental income will cease.

Maturity is an indication of the security of future income streams to investors. To calculate it, you use the rental income from each lease but weighted by the amount of income or space within the asset.

Why track this Asset Management KPI?

Maturity or WALE is a simple risk factor for the investor. It defines clearly the monetary risk of rental income into the future. A longer WALE is generally more attractive to investors, as it prolongs the possibility of exposing their money to risks created by costs associated with a vacancy and operating expenses. Longer maturity allows investors to plan future repairs and remodelling years ahead.

A longer maturity might set the terms for rent adjustments. However, investors should take into consideration at least inflation of upcoming years.

#Capital Gain

Capital gain is an increase in the value of a property asset compared to the original price. A capital gain may be short-term (one year or less) or long-term (several years).

Investors can impact on capital gains by improving the occupancy, gross rental income and maturity. Effectively this will improve beside capital gains, also total return. Properties like other investment vehicles usually depreciate due to wear and tear. Therefore it is important having a long term investment plan to keep the property value to appreciate.

Why track this Asset Management KPI?

Understanding capital gain is important from two points of view. Firstly, reserving your equity in terms of investment and secondly, having long term profits from the investments.

Capital gain is an important factor for any investor. If property value does not develop positively and rental income stays the same, inflation will cause the investment to depreciate. However, the capital gain is extremely important when talking about commercial real estate.

The value of a commercial property is linked to rental cash flow. Occupancy, GRI and Maturity are going hand in hand, building the foundation for capital growth through a cashflow modelling. In terms of a residential property capital gain tells how investors can prepare for financing future investments to keep property attractive for future tenants.

Typically you will realize the importance of capital gain when selling a property. Nowadays, it is a factor when reviewing the balance between equity and loans. Loan leverage is a remarkable part of the real estate business. Many times, the capital gain is additional security when using the property as collateral for the investment.