As a professional in the real estate industry, you’ve likely heard the saying that the value of a real estate investment is determined at the time of acquisition. While there’s truth to this statement, active asset management plays an equally crucial role – especially in today’s volatile market. Let’s dive into the key value drivers of asset management and explore how we can leverage them effectively.

The Shifting Sands of Real Estate

You’ve probably noticed the tectonic change in our industry lately. The interest rate shock, coupled with lower demand, changed tenant needs and higher vacancies, has put immense pressure on valuations. Some assets have even approached distressed situations – a scenario that would have been unthinkable just a few years ago.

As you know, the industry has even witnessed foreclosures of notable office buildings. Something which was quite unheard of just a few years ago and a strong reminder of how quickly the landscape can change. And it’s not just offices – this new reality applies across various asset classes.

Breaking Down the Return Components

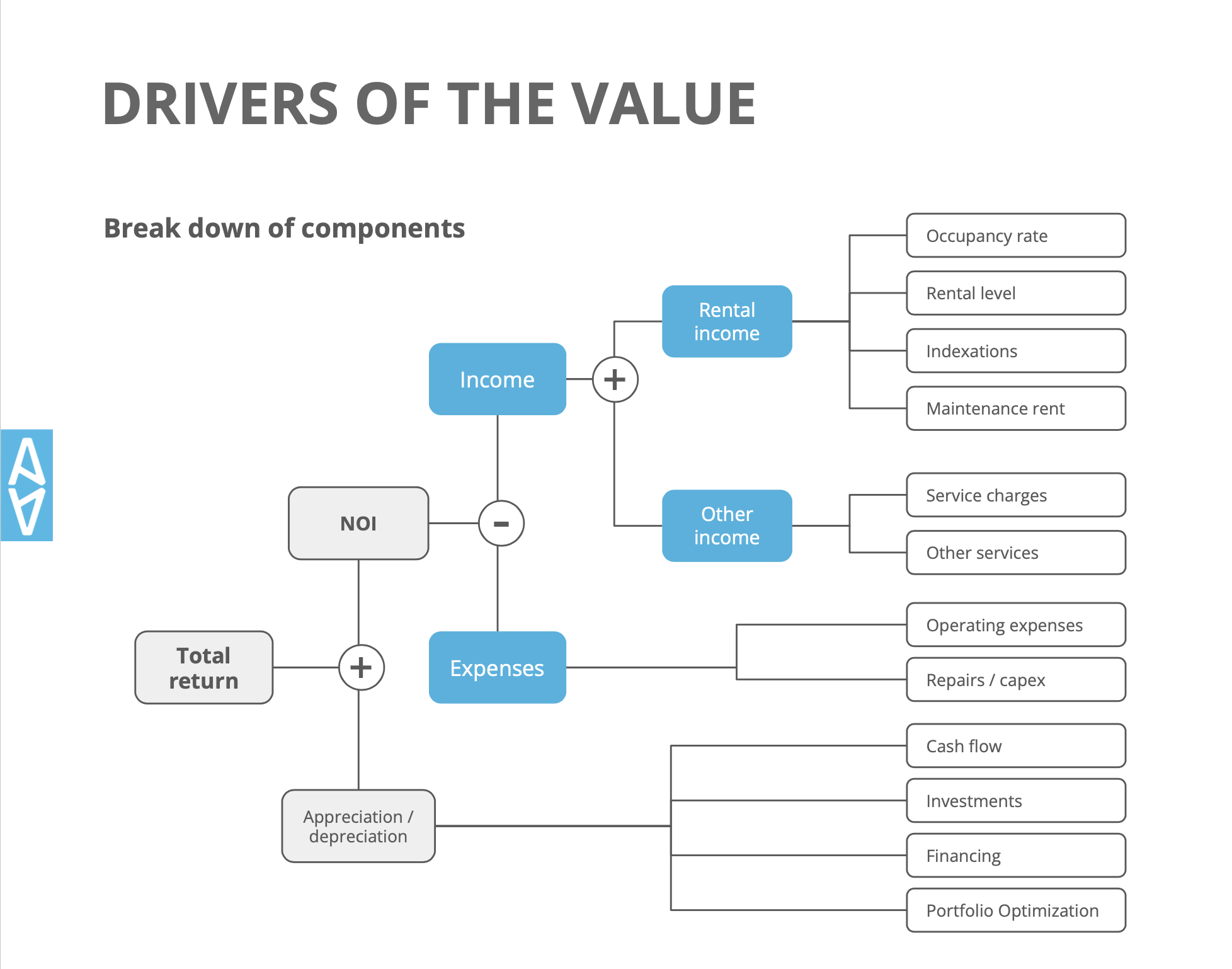

As the real value drives from operations, there has never been a greater need to have a major focus in the daily operations of asset management. To understand where the real value lies in those, let’s break down the components of a property investment’s return:

- Net Operating Income (NOI) – The “cash return”

- Appreciation or Depreciation – The change in the property’s value

The NOI in its turn is simply the income minus the operating expenses.

Each of these components can be divided into smaller operational items, which – with a closer look – start to make a lot of sense, since they have a real impact when conducted properly in operations. Let’s take a closer look at each of these elements and how they contribute to overall value.

Maximizing Rental Income in a Changing Market

Let’s start with the rental income – the source of (all) revenue in the real estate business. The conventional metrics follow occupancy (ideally fully let), rental level (ideally according to market rent), indexations (ideally covered against inflation) and maintenance rent in addition to the capital rent (to cover the expenses, though, this depends on the type of lease you have). However, as you’ve likely observed, the rules are changing. There’s an increasing emphasis on services and flexibility beyond basic rent. These range from basic conference rooms, and leased office furniture to short-term desk rentals and leasing e.g. charging poles for electric cars. You name it, there are a lot of gaps for a conventional real estate investor.

This shift and the need to support this new side of business presents a challenge for traditional lease admin systems. To adapt, we need more flexible tools that can handle a diverse registry of products and services, coupled with a CRM-style approach to capture and manage customer needs. Here the need for new type of tools is most imminent.

Optimizing Expenses: The Key to Healthier NOI

On the expense side, visual break-downs of costs according to your reporting structure are crucial to enable operational reporting. You probably agree that being able to benchmark and identify deviations is greatly beneficial in order to act, if anomalies evolve. Correcting them immediately will make a significant difference in your bottom line.

To keep the property commercially viable – and even improved – it is also vital to balance operating expenses with capital expenditure. Within this context, I am not going to cover the risk of stranded assets (if poor ESG performance), since that is the subject of its own. But needless to say, operating expenses and capex go hand in hand, since the high opex is typically the outcome of systematically neglected capex.

Modern software tools can help real estate investors optimize this balance and even assist in making systematic analyses for ESG improvements. Remember, “Green brings green” – properties with higher sustainability ratings tend to have better occupancy rates and valuations.

Forecasting and Managing Property Value

Let’s talk about the second part of the model: The change in the property’s value. One can model this with different approaches, but I have chosen the operational (traditional) view. When it comes to property value, it’s all about the net present value (NPV) of future cash flows, including the residual value. This involves managing free cash flow (after NOI), capex and financing cost of the debt, which – to some extent – is a highly operational matter.

With the right tools, one can forecast the cash flow, plan liquidity and follow-up and report on yield as well as on value development (leveraged/unleveraged). To be able to save and maintain data related to loans is also quite crucial. Ultimately, being able to see the returns and performance of the different properties in the portfolio allows you to optimise the risk/return structure of your entire portfolio.

Key Takeaways for Modern Asset Management

- Active asset management is a powerful value driver for any type of real estate investment – independent of the sentiment and turn of the market: Just break down the drivers into operational components to maximize their impact.

- Adapt to the new rules: The changing landscape calls for new software tools to support asset management operations.

- Don’t delay the implementation for tech to mature: The technology is proven and tested – it’s no longer experimental.

- Culture is key: Remember, software alone isn’t a silver bullet. Create processes and structures to enable your operations supported with the right stack of technology, and never underestimate the power of the culture you create. “You reap what you sow” – in good and bad by setting examples.

As we navigate these challenging times, it’s clear that a proactive, data-driven approach to asset management is more crucial than ever. By leveraging the right tools and strategies, we can unlock significant value, even in a volatile market. We are happy to assist with that.