Planning the annual budget for a property asset is a primary requirement for you as a property asset manager. And it requires a disciplined process with several steps.

Part of this process, and an important aspect to consider before making any investment decisions, is to get a clear picture of the following concerns: What is your budget? How are vacancies and rent roll developing? What are the expected costs and need for repairs? Can we execute the planned repairs?

First, the asset manager has to review what happened in the previous year related to occupancy and have a closer look at the real estate market’s condition. Is the vacancy rate up or down, and how is it trending? How is the maintenance plan holding up? Getting solid answers to these and other questions about what is happening with a particular asset, will no doubt require a vast amount of data.

CAPEX forecast and budget estimate

The next step is to prepare capital expenditure (CAPEX) estimates. In order to do this effectively, you need the skills to constantly forecast what will need to be repaired next year with the available money. Finally, you need to balance the funds escrowed by the lender with money that may come out of cash flow – and, possibly, from the owner’s pocket.

Utilise existing data when creating a budget in Assetti

Assetti’s new budgeting functionality allows you to create budgets on a property level directly from Assetti’s user interface. A budget can be created based on last year’s actuals or, as an example, you can select the budgeted income from the rent roll. With a couple of clicks, you can also define the hypothesis for the change in the rental income and operating expenses.

In addition to an operational budget, you can create different scenarios of the budget and compare those to the year’s actuals. This provides a variety of scenarios including the best case, baseline or worst case.

To create a budget from the user interface, you need to have some existing financial information and lease agreements. If you are about to create a budget for a new asset, you can easily import financial Information to the system first.

We encourage our customers to save lease agreements with detailed rent type information. This enables the system to use leases as a source for income budgeting.

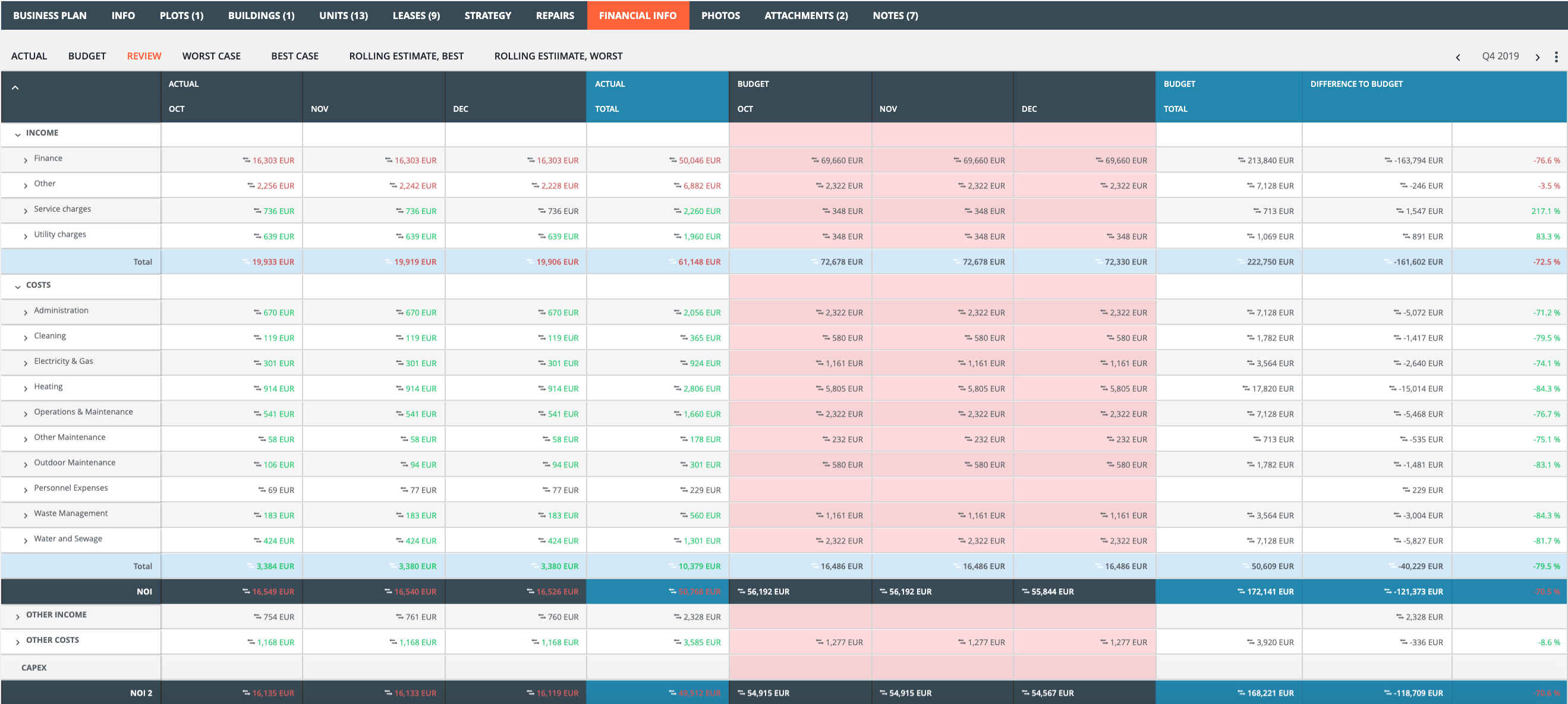

Comparison view and rolling estimate

With the comparison view, you can have an up-to-date rolling estimate to compare a budget or a scenario against the actuals at any time. Easy “traffic light” logic explains the situation with one view of how the financial situation is looking at the moment. Positive results are shown in green numbers, negative ones in red. In the comparison view, the actual values are shown for the past, ongoing, and remaining months of the selected year from the chosen budget.

Having the estimate and forecast for the year allows you to do a review for the quarter and make official quarterly reports with comments.

Automate your reporting

Remember that Assetti offers a standard and public Assetti API that can be utilised for aggregating the financial information from the accounting software. We also offer a wide variety of system-specific and productized integrations to financial systems and accounting software. Please read more about it on our integrations page.

Furthermore, Assetti supports your financial reporting with visual KPIs that include grids, dashboards and trends to following the financial performance of the properties. Assetti visualises the financial data and provides you with easy to read and understandable dashboards for internal and external use. Please read more about visual reporting from here.