Reporting in the real estate industry is quite often still based on manually compiled numbers from a number of sources. And Rent Roll reporting is certainly no exception to that. Even having a solid template for presenting all the related data is not quite enough: copying and pasting the information manually from system to system is extremely inefficient.

Why do you need Rent Roll Reports?

The rent roll is an all-purpose document that can be used by buyers and sellers, asset managers, property managers, real estate investors and landlords, and lenders. It provides a quick snapshot of one’s tenant base, the property performance and the gross rental income. It’s also an important document used in real estate transactions since many investors and banks request the report as part of their due diligence process.

How to improve rent roll reporting?

A good rent roll report needs to be easy to update and easy to understand. Sounds simple, but how to turn this into a working solution?

Make Updating Your Rent Roll easy

It might be a good idea to update the rent roll each year at the same time. But in reality, you should do your best to update the rent roll anytime that you make significant changes to the information that you track on this record.

You renew a lease with a tenant or increase rent? Make sure you add those changes to the roll as soon as possible. Is a tenant moving out early so you won’t be making a profit for a short period? It’s time for another update. If you have a solution in place where updating information is easy and other calculations and numbers affected by those changes are updated automatically as well – this will save you a lot of time. And when updating your rent roll (report) frequently, you will have easy access to an up-to-date document, which can help to organize and solidify your investments.

Make changes visible

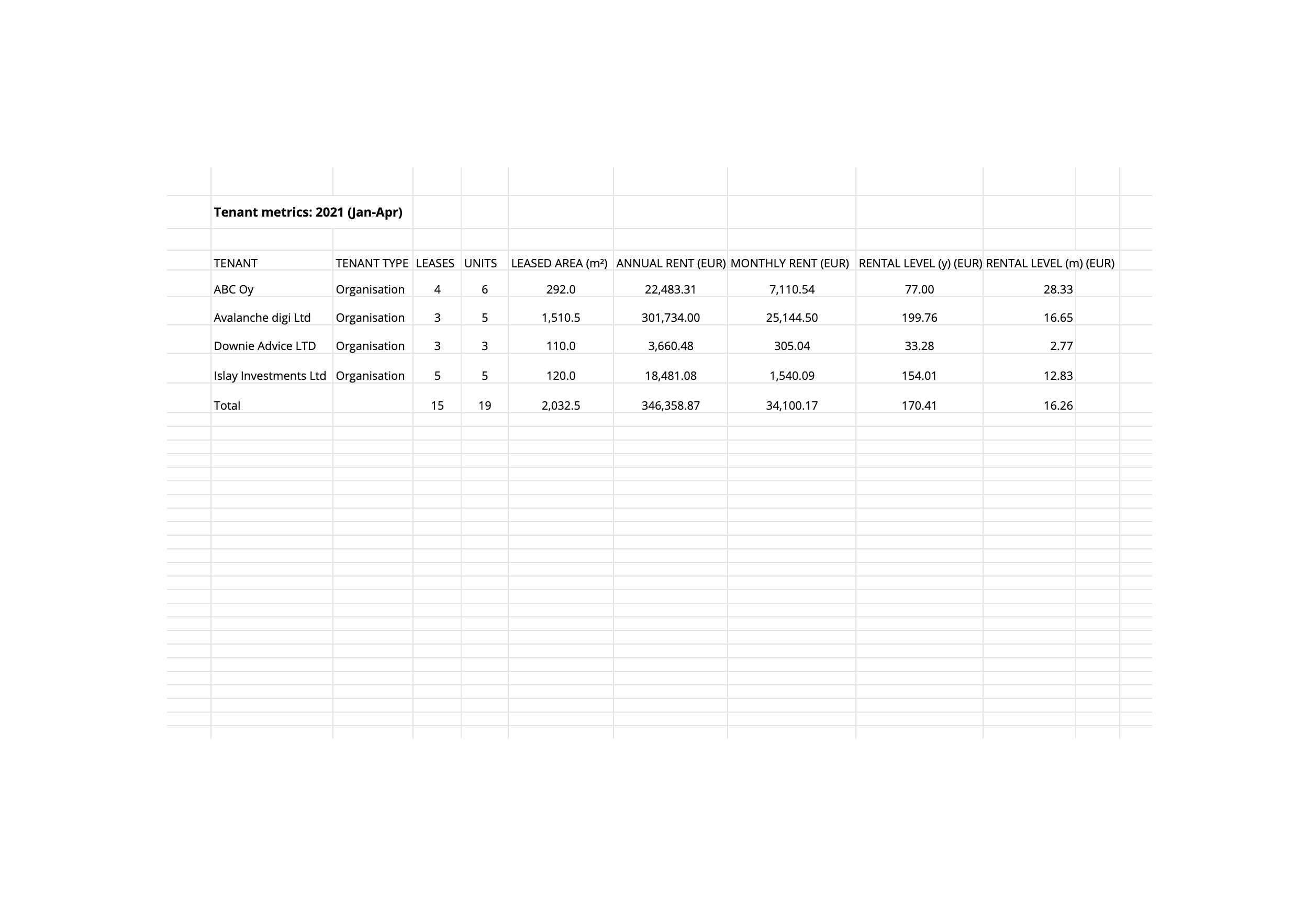

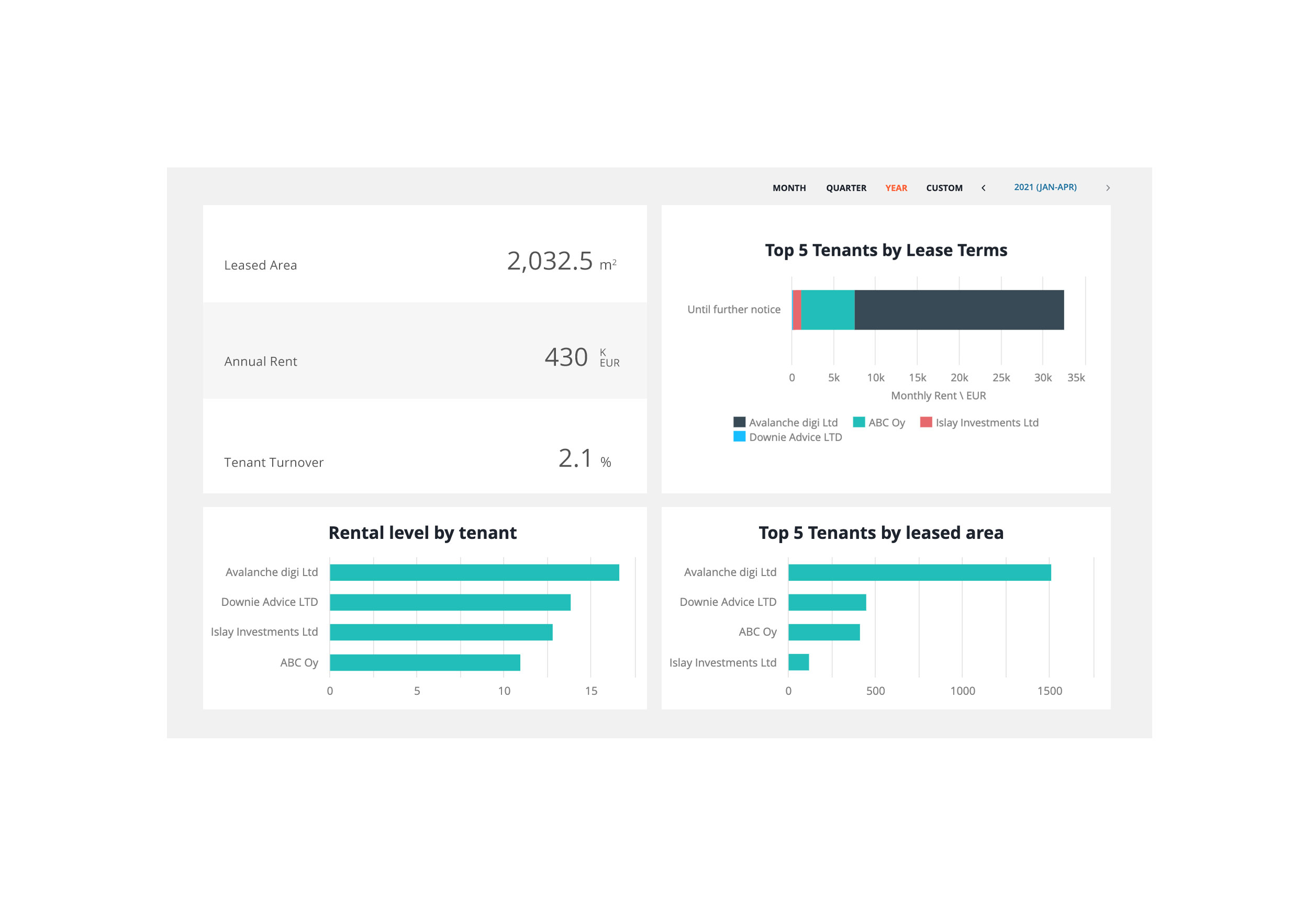

When having all rent roll data accessible, updated and on hand, you can quickly analyze the property and see which units are underperforming and what the potential lift in rental income could be with a remodel. It is also worth having a closer look at more specific KPI’s like rental level by the tenant, lease terms, breakdown by units or best-case/worst-case scenarios.

Overseeing those for example on an excel spreadsheet is possible, but there are more convenient ways. But see for yourself. If you have a look at the file and the graphics here, which one is giving you a better picture of your rent roll and tenant data?

Assetti is a handy tool for analyzing your rentals in general, but especially from a locational/geographical perspective – because here you can see where there is additional room to grow. You can for example compare your roll rolls to the market rates in that one specific area the property is located in. Based on that comparison, you can decide if you can apply a rental increase to match those rates. In some cases, a remodel will have to happen first, but it’s still good information to have on hand.

Make Rent Roll Reports easy to understand

It is not always worth your time to dig out leases or to try to recall specific, important details about your properties. Having a rent roll prepared eases up finding this information when you need it.

You have the numbers, you have accuracy – Now you just need to make them easy to understand. No one wants to study endless reports with hundreds of rows of numbers presented. Use cases help you to define which kind of data you need for a precise Rent Roll Report.

Rent roll Reports for comparisons and due diligence

If you are a landlord and want to gain a quick snapshot of the current gross rental income as well as tenancy periods and rent expected vs rent collected. This gives you a great understanding of vacant periods, as well as comparing expected gross income over a time period to realized income. The ideal Rent Roll Report helps you to efficiently review your current and past tenancies as well as their income levels.

Some buyers are willing to pay more for a rental property when they know the future income stream is predictable. If the tenant’s lease is coming up for renewal in the next few months, a seller who proactively extends the lease may be able to sell the property at a higher price since the tenant has been “stabilized” for another 12 months.

Reporting for acknowledging risks

As a Property Manager, you might use the Rent roll report to gain insight into the tenancy history of a property or unit. In this case, it is interesting for you to know details related to vacancies and their length, as well as reviewing those dates when leases are going to expire. If you acknowledge well ahead that a lease is expiring soon, reach out to the current tenant. You can either offer a lease extension or begin the process of showing the property and finding new tenants. This will allow you to minimize vacancy periods.

You might also include important details like square footage, bedrooms, and bathrooms as well as rent amount to your Rent Roll Reports. That will help you to quickly compare your properties or potential investments against other similar properties on the marketplace.

Whether you use your Rent roll Reporting for overseeing rental income, comparisons, risk identification or for evaluating a potential real estate investment – Data is and always will be key. Even though you might maintain data in different systems, you can streamline and integrate those into digital Property Asset management systems. From there you can evaluate and visualize your data and convert it to reports & analytics for external and internal use.