Having a solid knowledge of your financial situation is an important part of a successful business. It means that you need to understand not only the money you currently have but also the money you may deposit or withdraw over the next few months or years. At that point, budgeting and forecasting are becoming significant.

Budgeting 2.0

Back in 2020, we released our first version of Assettis’ Budgeting and Forecasting functionality, allowing you to create budgets on a property level directly from our Assetti user interface. Now we have been developing this feature further to provide our users with a more advanced tool for modeling different business scenarios and monitoring a property’s financial performance against the targets.

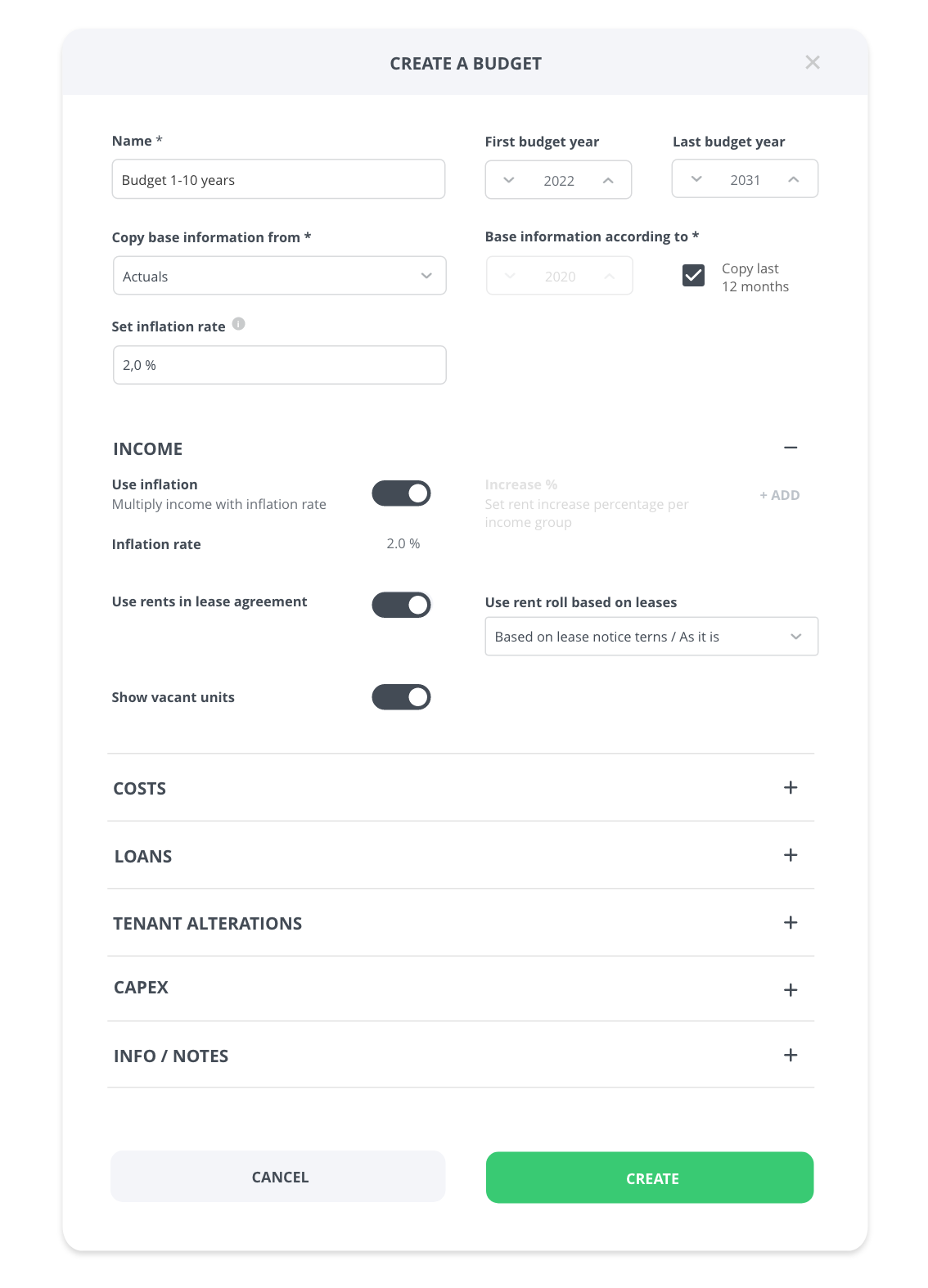

Although the most common timescales are quarterly budgets and annual budgets, you can now also create a multiple-year budget within Assetti. This kind of long-term budgeting is providing our users with the possibility to create an up to 10-year budget based on information related to Pnl, leases, loans, and repairs. Based on the selected budget configuration, Assetti is calculating annual increases in values, which then can be reviewed on a monthly, quarterly, and yearly basis.

Long term financial performance against the targets

In order to cover planned activities and necessary expenses, you are able to create a budget that is based on last year’s actuals or, as an example, select the budgeted income from the rent roll. With a couple of clicks, you can also define changes in the rental income and operating expenses by applying an inflation rate. That enables you to decide where to prioritize your spending to achieve your most important goals for the upcoming year(s).

Taking into account all available past and present data, Assetti will help you create more accurate predictions when budgeting for the future. In addition to an operational budget, you can create different scenarios of the budget and compare those to the year’s actuals. This provides a variety of scenarios including the best case, baseline, or worst-case scenario. Those will help businesses to forecast, plan, allocate and spend money wisely.

Having additionally the possibility to add loans, repairs, and CAPEX to budgets will optimize your financial planning with detailed analyses. Accurate comparisons of current and future income and expenses for your properties will give you instant insights into their performance.

Usability improvements

With our updated budgeting feature, we are as well introducing a couple of new usability improvements. Via our new pop-up window, it is easier for the user to understand which data will be taken into account when creating a budget. Also navigating between different views and budgets is now grouped and provides a clearer selection of items. Assetti now as well remembers the names you have given for your Budgets. Once a budget with a certain name is created, it will be shown via a drop-down select when adding a new budget. That enables you to use the same name easily for multiple properties and will save your time and avoid wrong data entry when creating budgets. You can modify your budgeting anytime and are able to create up to 5 different budget scenarios within Assetti.

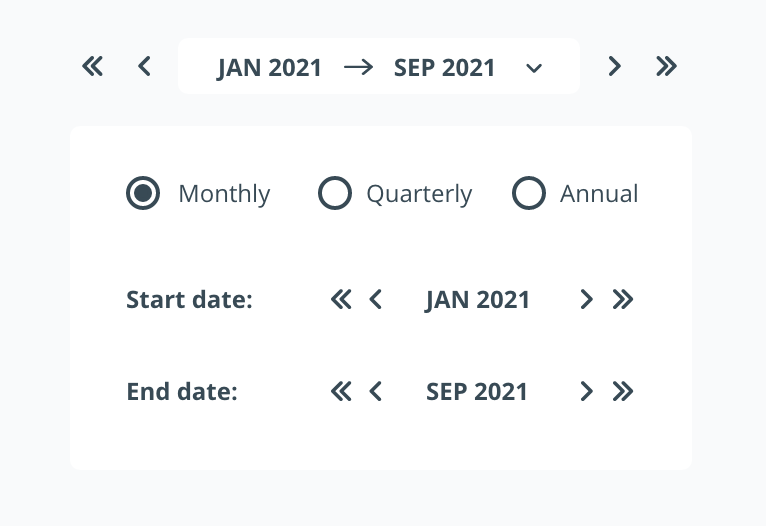

Improved calendar element

Our improved time selection enables you to see data for a certain period of time having the option to review financials on a monthly, quarterly, or annual basis. That gives you the possibility to now review multiple years within one view. Our color-coded data will make it easy for you to understand whether actuals are above or below the set budget.

The budgeting functionality is part of our Professional and Enterprise subscription plan.

If you want to know more about Assetti and the new budgeting functionality, please contact us. We are happy to help!