The year-end is typically filled with blog posts and publications about how fantastic and the awesome year it has been – or what the predictions are for 2020. I try to cut it shorter.

2020, the change is here?

According to Unissu, PropTech has proved itself to be one of the fastest-growing investment sectors in the world right now, and like any growing industry, change is inevitable. However, what has become evident to me during 2019, is that the change is slower than we would like to think – or hope for.

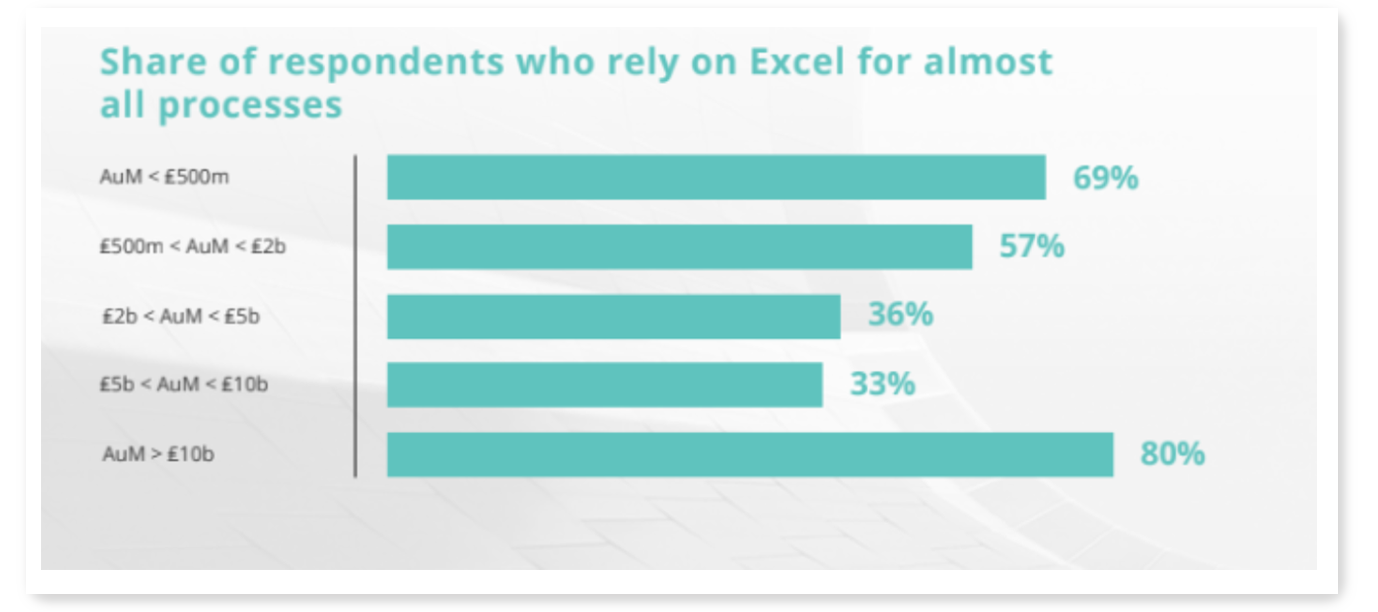

Anubhuti Verma from Oxane Partners describes one issue in her blog quite thoroughly and with great detail: Excel remains digital transformation’s biggest competitor. This is not only valid for smaller RE investors (AuM < 500 M£), but even for large-cap investors as well.

Spreadsheets are not bad per se, quite the contrary. Excel would not be the world’s most used and widest spread software if it was lousy in its core intent and flexibility – but this reflects the essence of the industry characteristics, which is about broken data and manual processes. This effectively leads to inefficiencies and high management costs.

This is the subject I covered in my blog post earlier this year about Management fees under pressure and how PropTech can help, and which was further evidenced in the latest news of Norway’s oil fund to axe real estate arm and reduce target allocation.

It will for sure take a few more years to fix this

Can AI fill in the gaps?

Then, one of the key topics of 2019, #AI will evidently play a role in parsing together the gaps in our data. However, I see the role of Machine learning being more decisive with tangible benefits in automating lower value add, repetitive tasks, This applies to e.g. handle service requests or procurement invoices, where the number of transactions is high and similar in nature and content.

To conclude: 2019 cannot be summarised without a notion of WeWork, which must have been the single biggest event of the year for the whole industry – whether you are on real estate or proptech side of it.

The case has been thoroughly analysed by a number of wiser human beings than me (e.g. Dror Poleg and Anthony Slumbers, among others), so let’s spare yet another analysis.

Let’s just settle by concluding, that even WeWork was a bit of a VC-inflated bubble and might shrink to fit- But the concept is more valid than ever. The hospitality business model will increase and get more exposure across all asset classes and geographies. And whether you call Flexispace, a Space-as-a-Service or something else, it will evidently grow. When it will be a dominant ( >50% market share), cannot be predicted, but someday it will!

All eyes on Tenant Engagement Software

Which then leads to my third lesson learned and prediction for the 2020s: Tenant engagement software will increase in popularity. Not all the existing players and operators have the possibility to build a software of their own. So they but will buy one – most likely a SaaS application. There will be a number of investment rounds into companies developing and operating tenant and/or space occupier experience software.

So lessons learnt and three predictions for the new decade

- Change will be slower than anticipated – throughout history, people tend to overestimate change in the short term, and underestimate on the long term

- AI will get its rooting in automating lower-level repetitive tasks. Later and to a lesser extent in the investment phase, where individual models built by humans with Excel will play a dominant role, yet another decade

- Tenant experience apps and platforms will be the next “hot topic” for the next three, four years

With these thoughts, I wish you a Happy New Year and all the success for the new decade!